ZenBot now has the ability to scan for bullish or bearish imbalances in option open interest. This serves as another point of confluence to helping us understand if there is institutional presence, in which direction and at what price points.

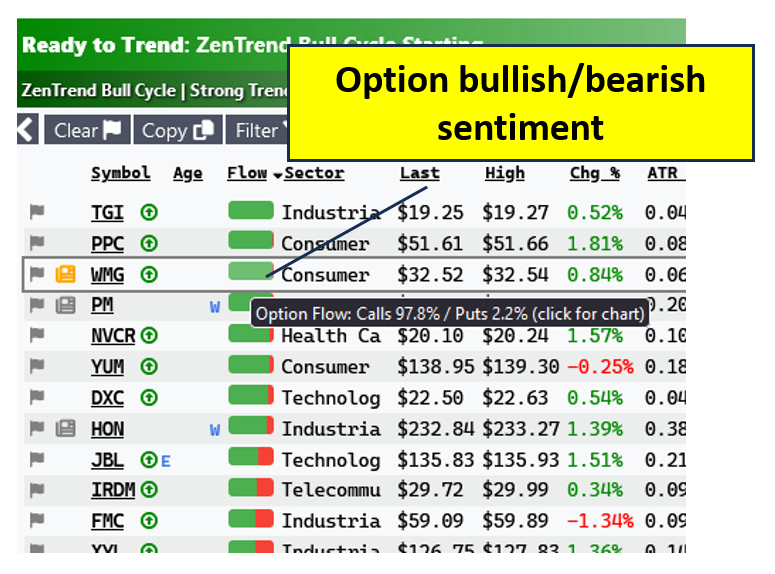

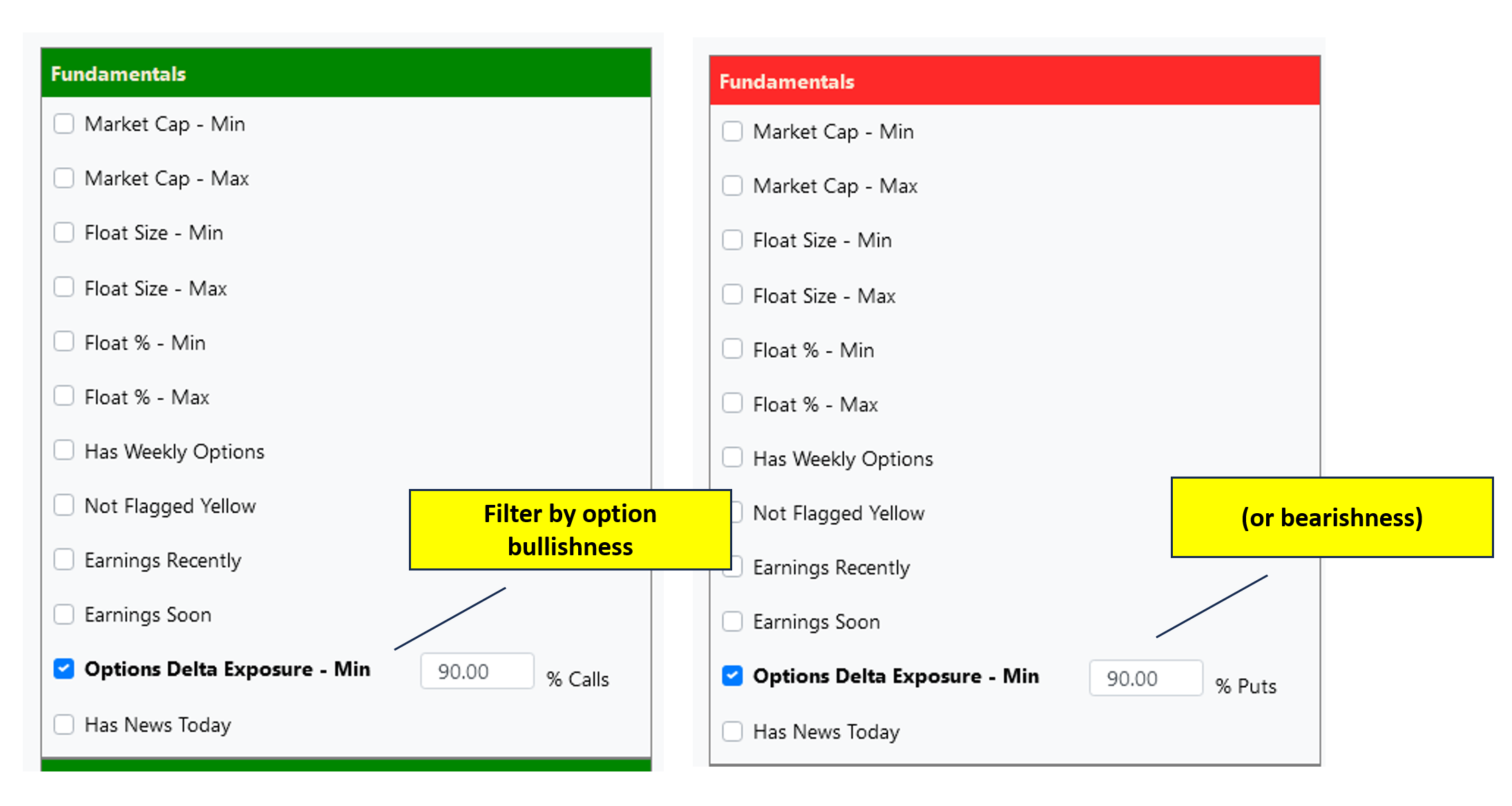

Zen will now show you a new “Flow” column which represents the “net delta exposure” or DEX of all options positions up to 90 days out. You’ll see at a glance if other traders and large options holders are bullish or bearish on the stock. You can sort by options flow and use it as a filter or in your custom scans.

Hover over the flow bar to see the ratio of calls to puts. Click the flow bar to see the options chart which shows the bullish / bearish balance of options at all strikes. The strongest stocks will have a heavy balance toward calls and will have